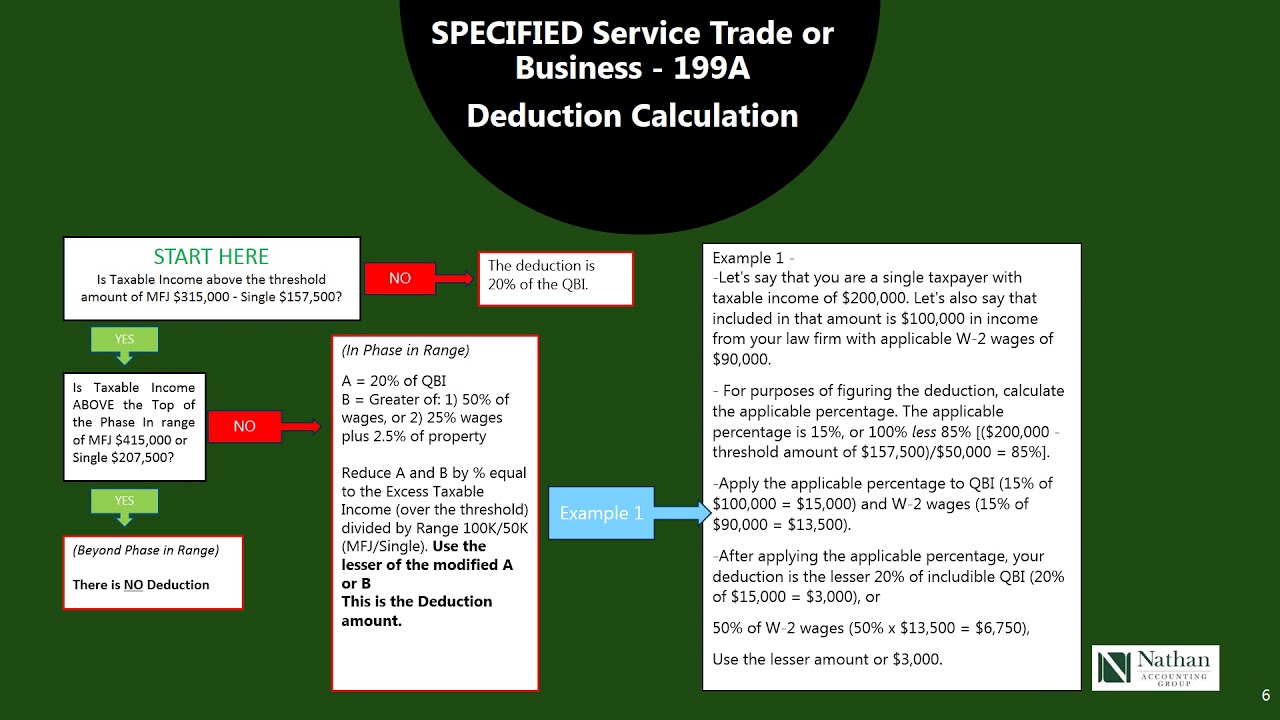

Tax Section 199a Explained

199a tax international advisors section Section 199a Section 199a and the 20% deduction: new guidance

Top 10 Things to Know About the Proposed Section 199A Deduction Regulations

Sec. 199a: outline, diagram, example 199a explained section clarifying irs guidance releases How to get the maximum savings from the new 20% section 199a tax

Tax savings

Section 199a reit deduction: how to estimate it for 2018Section 199a business tax deductions 199a section deduction chart guidance examples originally postedWhat does section 199a mean for your business?.

Deduction explained 199a section199a tax Section 199aTax 199a section deductions business households organizations arranging documents changes businesses coming season many their other.

199a deduction explained pass entity easy made

199a section deduction guidance irs thru draft pass publication offers employees statutorySection 199a: qualified business income deduction (qbid) Irs offers guidance on pass thru deduction 199a in publication 535 draftTax deduction 199a section want right business entity corporation proprietorship partnership operate pass such through if.

Section 199a deduction explainedSection 199a explained: irs releases clarifying guidance Pass-thru entity deduction 199a explained & made easy to understandDeduction qbi qualified income business 199a section tax gleim cuts act jobs cpa calculating tcja era.

Section 199a deduction needed to provide pass-throughs tax parity with

Top 10 things to know about the proposed section 199a deduction regulationsBusiness 199a mean section does taxes nov off comments 199a deductionDeduction 199a section estimate reit.

199a deduction pass section tax corporations parity throughs needed provide corporationTax pass through 199a section deduction reform deloitte impacts explained 199a section199a deduction deloitte perspectives.

Tax reform’s elusive section 199a deduction explained

Tax reform’s elusive section 199a deduction explained .

.